| Availability: | |

|---|---|

| Quantity: | |

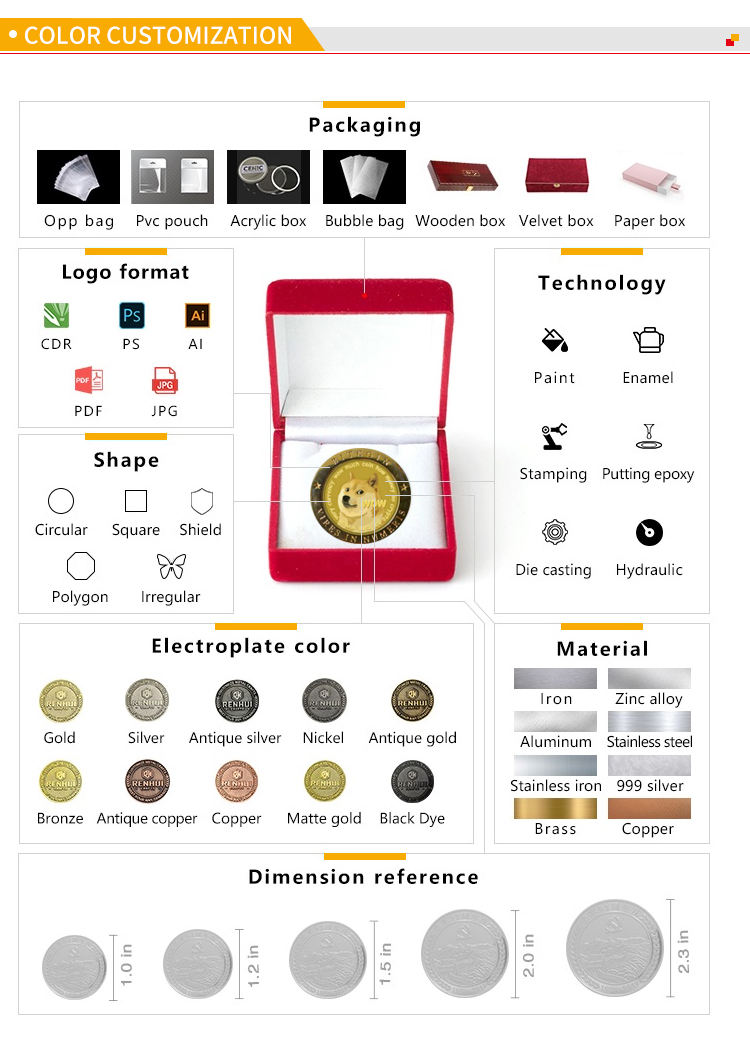

| Product | Souvenir Coins/ Challenge coins/ Commemorative Coins/ Proof Coins |

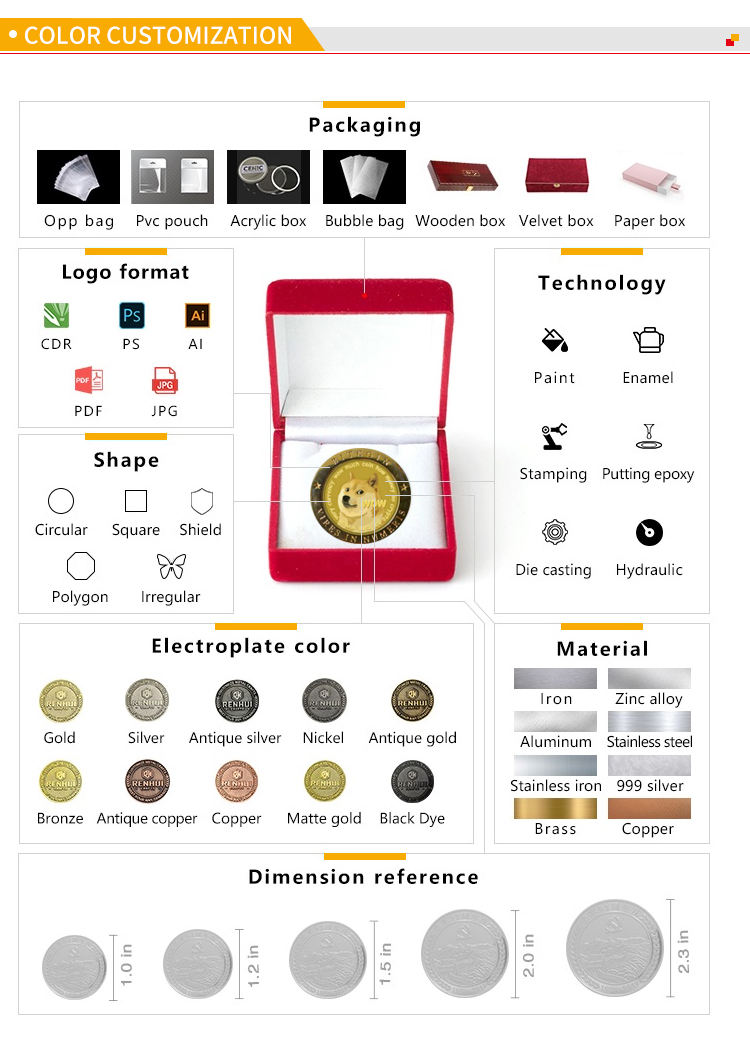

| Size | 1.5", 1.75", 2", 2.25", 2.5", 3". also as your request |

| Thickness | 2mm,2.5mm,3mm,3.5mm,4mm,5mm,6mm |

| Material | Brass, Copper, Zinc alloy, Iron, Aluminum, etc. |

| Process | Die Struck /Die Casting |

| Plating | Shiny Finished: Gold/Silver/Nickel/Copper/Brass Antique Finished: Antique Gold/Antique Silver/Antique Copper/Antique Brass |

| Painting | Soft Enamel/Imitation Hard Enamel/Poly Enamel |

| Epoxy | With/Without, as customer request |

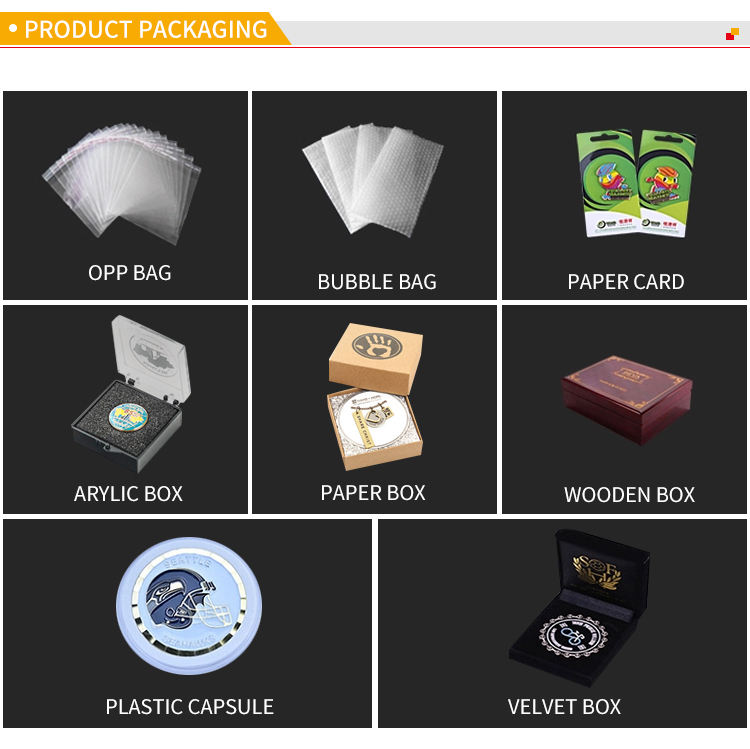

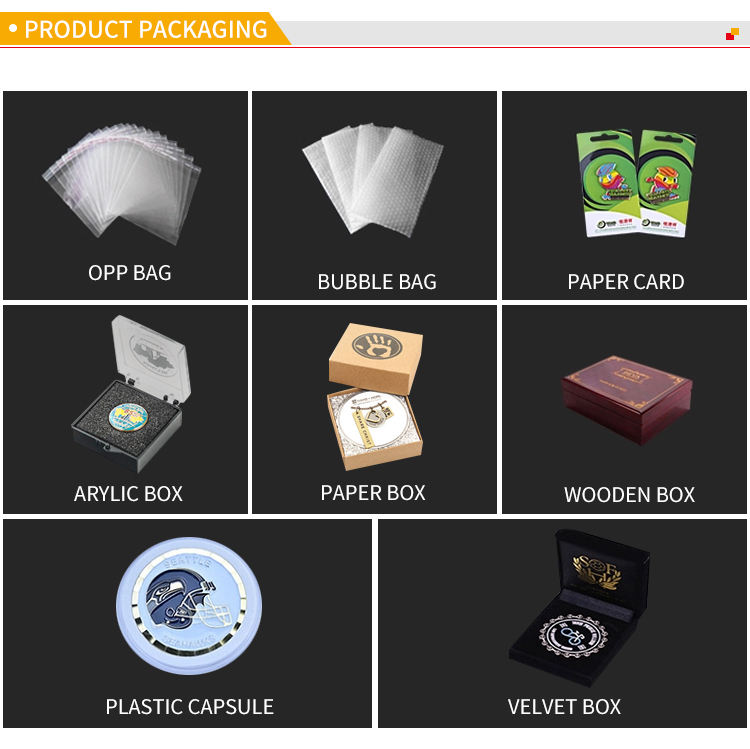

| Packing | Poly bag, PVC pouch, opp bag, plastic box, velvet pouch, etc |

| MOQ | NO MOQ |

| Sample Time | 2D Design - 7days after artwork confirmed 3D design – 10 days after artwork confirmed |

| Lead Time | 12-20 days after sample confirmed |

| Delivery time | 12-20 days for MOQ (after samples be approved) |

| Shipping | By Air express: DHL, FedEx, UPS, etc. By Sea: from ShenZhen or HongKong port |

| Payment Method | T/T, Western Union, Alipay and Paypal |

| Product | Souvenir Coins/ Challenge coins/ Commemorative Coins/ Proof Coins |

| Size | 1.5", 1.75", 2", 2.25", 2.5", 3". also as your request |

| Thickness | 2mm,2.5mm,3mm,3.5mm,4mm,5mm,6mm |

| Material | Brass, Copper, Zinc alloy, Iron, Aluminum, etc. |

| Process | Die Struck /Die Casting |

| Plating | Shiny Finished: Gold/Silver/Nickel/Copper/Brass Antique Finished: Antique Gold/Antique Silver/Antique Copper/Antique Brass |

| Painting | Soft Enamel/Imitation Hard Enamel/Poly Enamel |

| Epoxy | With/Without, as customer request |

| Packing | Poly bag, PVC pouch, opp bag, plastic box, velvet pouch, etc |

| MOQ | NO MOQ |

| Sample Time | 2D Design - 7days after artwork confirmed 3D design – 10 days after artwork confirmed |

| Lead Time | 12-20 days after sample confirmed |

| Delivery time | 12-20 days for MOQ (after samples be approved) |

| Shipping | By Air express: DHL, FedEx, UPS, etc. By Sea: from ShenZhen or HongKong port |

| Payment Method | T/T, Western Union, Alipay and Paypal |

Gold has captivated humanity for centuries, with its allure as a symbol of wealth, power, and beauty. Among the various forms of gold investment, gold metal coins have stood the test of time, embodying both historical significance and intrinsic value. This article explores the enduring appeal of gold metal coins and sheds light on their importance in the world of precious metal investments.

A Rich History

Gold metal coins have a rich history that spans millennia. They were first introduced as a form of currency in ancient civilizations, such as the Lydians in the 7th century BCE. These coins served as a medium of exchange, enabling trade and facilitating economic growth. Throughout history, gold coins have been minted by various empires and nations, showcasing their power and influence.

Intrinsic Value and Security

One of the key reasons behind the popularity of gold metal coins is their inherent value. Unlike paper currency, gold possesses a tangible and enduring worth. Metal coins are made from high-quality gold, often with a purity of 99.99%, making them a secure store of value. Investors appreciate the stability and resilience that gold offers, particularly during times of economic uncertainty or market volatility.

Aesthetic Appeal and Collector's Value

Gold metal coins are not only prized for their financial worth but also for their aesthetic appeal. The intricate designs and craftsmanship that adorn these coins make them truly captivating. Minting techniques and advancements in technology have allowed for exquisite detailing and fine finishes. Furthermore, certain gold coins have limited mintages, making them highly sought-after by collectors. These rare pieces can command significant premiums above their intrinsic gold value.

Diversification and Portfolio Protection

In the realm of investment, gold metal coins provide a means of diversification and portfolio protection. As a tangible asset, gold has traditionally served as a hedge against inflation and economic downturns. By including gold coins in an investment portfolio, investors can reduce their exposure to risks associated with other financial assets, thus enhancing the overall stability of their holdings.

Liquidity and Accessibility

Gold metal coins offer liquidity and accessibility to investors. Due to their worldwide recognition and standardized sizes, gold coins can be easily bought, sold, and traded in the global market. The liquidity of gold allows investors to convert their holdings into cash quickly, making it a versatile asset for wealth preservation and capital appreciation.

Conclusion

Gold metal coins continue to capture the imagination of investors and collectors alike. With their rich history, intrinsic value, aesthetic appeal, and portfolio diversification benefits, these coins have cemented their place in the world of precious metal investments. Whether viewed as a tangible store of wealth, a collector's item, or a means of preserving capital, gold metal coins stand as a timeless testament to humanity's fascination with the allure of gold.

Gold has captivated humanity for centuries, with its allure as a symbol of wealth, power, and beauty. Among the various forms of gold investment, gold metal coins have stood the test of time, embodying both historical significance and intrinsic value. This article explores the enduring appeal of gold metal coins and sheds light on their importance in the world of precious metal investments.

A Rich History

Gold metal coins have a rich history that spans millennia. They were first introduced as a form of currency in ancient civilizations, such as the Lydians in the 7th century BCE. These coins served as a medium of exchange, enabling trade and facilitating economic growth. Throughout history, gold coins have been minted by various empires and nations, showcasing their power and influence.

Intrinsic Value and Security

One of the key reasons behind the popularity of gold metal coins is their inherent value. Unlike paper currency, gold possesses a tangible and enduring worth. Metal coins are made from high-quality gold, often with a purity of 99.99%, making them a secure store of value. Investors appreciate the stability and resilience that gold offers, particularly during times of economic uncertainty or market volatility.

Aesthetic Appeal and Collector's Value

Gold metal coins are not only prized for their financial worth but also for their aesthetic appeal. The intricate designs and craftsmanship that adorn these coins make them truly captivating. Minting techniques and advancements in technology have allowed for exquisite detailing and fine finishes. Furthermore, certain gold coins have limited mintages, making them highly sought-after by collectors. These rare pieces can command significant premiums above their intrinsic gold value.

Diversification and Portfolio Protection

In the realm of investment, gold metal coins provide a means of diversification and portfolio protection. As a tangible asset, gold has traditionally served as a hedge against inflation and economic downturns. By including gold coins in an investment portfolio, investors can reduce their exposure to risks associated with other financial assets, thus enhancing the overall stability of their holdings.

Liquidity and Accessibility

Gold metal coins offer liquidity and accessibility to investors. Due to their worldwide recognition and standardized sizes, gold coins can be easily bought, sold, and traded in the global market. The liquidity of gold allows investors to convert their holdings into cash quickly, making it a versatile asset for wealth preservation and capital appreciation.

Conclusion

Gold metal coins continue to capture the imagination of investors and collectors alike. With their rich history, intrinsic value, aesthetic appeal, and portfolio diversification benefits, these coins have cemented their place in the world of precious metal investments. Whether viewed as a tangible store of wealth, a collector's item, or a means of preserving capital, gold metal coins stand as a timeless testament to humanity's fascination with the allure of gold.